Greek PM, FinMin discuss savings deadlock with troika

Updated: 2012-07-31 10:29:39

Same shit, different day….

The US Republican presidential candidate meets former Polish president Lech Walesa in Gdansk

The US Republican presidential candidate meets former Polish president Lech Walesa in Gdansk

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our European stock market rally peters outJulia Kollewe

European stock market rally peters outJulia Kollewe

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital edition All our Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to comments c Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital

Turn autoplay off Turn autoplay on Please activate cookies in order to turn autoplay off Jump to content s Jump to comments c Jump to site navigation 0 Jump to search 4 Terms and conditions 8 Edition : UK US Sign in Mobile Your profile Your details Your comments Your clippings Your lists Sign out Mobile About us About us Contact us Press office Guardian Print Centre Guardian readers' editor Observer readers' editor Terms of service Privacy policy Advertising guide Digital archive Digital edition Guardian Weekly Buy Guardian and Observer photos Today's paper The Guardian G2 features Comment and debate Editorials , letters and corrections Obituaries Other lives Sport EducationGuardian Subscribe Subscribe Subscribe to the Guardian iPhone app iPad edition Kindle Extra Guardian Weekly Digital As outlined in a popular October 2011 video on the European debt crisis, we are well aware of the serious nature of the problems facing the financial markets. However, our market models have been telling us, and continue to tell us, to be open to ongoing bullish surprises. Debt market and economic fundamentals [...]

As outlined in a popular October 2011 video on the European debt crisis, we are well aware of the serious nature of the problems facing the financial markets. However, our market models have been telling us, and continue to tell us, to be open to ongoing bullish surprises. Debt market and economic fundamentals [...] Political leaders in Greece have agreed on most of the austerity measures demanded by its creditors and are now eyeing pension and wage cuts to find the final 1.5 billion euros of savings still needed, a source close to the talks said on Sunday.

read more

Political leaders in Greece have agreed on most of the austerity measures demanded by its creditors and are now eyeing pension and wage cuts to find the final 1.5 billion euros of savings still needed, a source close to the talks said on Sunday.

read more Video covers stocks, bonds, precious metals, and commodities. ETFs: VTI SLV TLT DBC JJC GLD IYM FXI EEM DBO $VIX VEU $SPX RSP $NYA $INDU EFA QQQ

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Video covers stocks, bonds, precious metals, and commodities. ETFs: VTI SLV TLT DBC JJC GLD IYM FXI EEM DBO $VIX VEU $SPX RSP $NYA $INDU EFA QQQ

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Blogs Estonian Austerity Models Healthy Economic Correction Jul 27 2012 As Eurozone governments try to figure out how to sell austerity” to their disgruntled citizens and the rest of the world wonders how in the heck Europe is ever going to get itself out of its mess , the tiny Eastern European nation of Estonia offers a glimmer of hope , as well

Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Blogs Estonian Austerity Models Healthy Economic Correction Jul 27 2012 As Eurozone governments try to figure out how to sell austerity” to their disgruntled citizens and the rest of the world wonders how in the heck Europe is ever going to get itself out of its mess , the tiny Eastern European nation of Estonia offers a glimmer of hope , as well The first two times the S&P 500 hit the downward-sloping trendline, stocks reversed (below red arrows). The last two attempts, including today’s, have been a little more impressive (below green arrow). The chart below is as of 12:48 p.m. EDT. Where stocks close is more important.

The first two times the S&P 500 hit the downward-sloping trendline, stocks reversed (below red arrows). The last two attempts, including today’s, have been a little more impressive (below green arrow). The chart below is as of 12:48 p.m. EDT. Where stocks close is more important.

Is the market trying to turn from a reasonable area of support? The answer appears to be yes:

The orange line C is 61.8% (Fibonacci) of the move from RET-A to RET-B. The market held above the orange FIB line near point D.

The blue trendline E acted as resistance near the red arrow. [...]

Is the market trying to turn from a reasonable area of support? The answer appears to be yes:

The orange line C is 61.8% (Fibonacci) of the move from RET-A to RET-B. The market held above the orange FIB line near point D.

The blue trendline E acted as resistance near the red arrow. [...] Almost exactly one year ago I wrote a blog post entitled ECB success shows extent of failure. The ECB had just announced its intention to buy Spanish and Italian bonds. Interest rates on the bonds had fallen significantly. The markets were happy. As I pointed out, this was more an indication of policy failure than [...]

Almost exactly one year ago I wrote a blog post entitled ECB success shows extent of failure. The ECB had just announced its intention to buy Spanish and Italian bonds. Interest rates on the bonds had fallen significantly. The markets were happy. As I pointed out, this was more an indication of policy failure than [...] As of Wednesday’s close, the S&P 500 remained in a bullish uptrend. Nothing overly concerning has occurred yet. The patterns shown in the video are on our “good to be aware of” list.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to [...]

As of Wednesday’s close, the S&P 500 remained in a bullish uptrend. Nothing overly concerning has occurred yet. The patterns shown in the video are on our “good to be aware of” list.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to [...] The light switch nature of the present day financial markets is alive and well. During Tuesday’s session the S&P 500 was down 21 points intraday with the markets looking very vulnerable. Add in a market friendly Fed story from the WSJ and this morning’s comments from the ECB and you flip the switch [...]

The light switch nature of the present day financial markets is alive and well. During Tuesday’s session the S&P 500 was down 21 points intraday with the markets looking very vulnerable. Add in a market friendly Fed story from the WSJ and this morning’s comments from the ECB and you flip the switch [...] Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Features Current Analysis Capital Controls and the Death of Money Market Funds Jul 25 2012 Money market funds MMF hold 2.7 trillion in total assets , acting as a safe haven where , according to the U.S . Securities and Exchange Commission SEC roughly 40 of investment company assets are held . As a result , some 20 of the cash balances of all U.S

Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Features Current Analysis Capital Controls and the Death of Money Market Funds Jul 25 2012 Money market funds MMF hold 2.7 trillion in total assets , acting as a safe haven where , according to the U.S . Securities and Exchange Commission SEC roughly 40 of investment company assets are held . As a result , some 20 of the cash balances of all U.S  I’m in Alaska, amid moose and bear, trying to steal some time away from the absurdities of American politics and economics. But even at this remote distance I caught wind of Sanford Weill’s proposal this morning on CNBC that big banks be broken up in order to shield taxpayers from the consequences of their losses. [...]

I’m in Alaska, amid moose and bear, trying to steal some time away from the absurdities of American politics and economics. But even at this remote distance I caught wind of Sanford Weill’s proposal this morning on CNBC that big banks be broken up in order to shield taxpayers from the consequences of their losses. [...] (1) The Olympics: Today’s image (above) is from a series of pre-Olympics billboard hijackings that a guerrilla group called Brandalism did recently (reported at Buzzfeed). Part of what they’re protesting is the excessive control over branding by the Olympic committee, … Continue reading →

(1) The Olympics: Today’s image (above) is from a series of pre-Olympics billboard hijackings that a guerrilla group called Brandalism did recently (reported at Buzzfeed). Part of what they’re protesting is the excessive control over branding by the Olympic committee, … Continue reading → As outlined in a July 22 video, there are still numerous reasons to be bullish relative to the intermediate-term outlook for stocks. However, there has been significant deterioration to the short-term picture in the last three trading sessions. With the S&P 500 down 21 points and on the technical ropes, the Wall Street Journal [...]

As outlined in a July 22 video, there are still numerous reasons to be bullish relative to the intermediate-term outlook for stocks. However, there has been significant deterioration to the short-term picture in the last three trading sessions. With the S&P 500 down 21 points and on the technical ropes, the Wall Street Journal [...] I have just arrived in Chicago to talk about the Eurozone crisis at a conference organised by the Goethe Institute and the Federal Reserve Bank of Chicago. It is very easy to become self-centred given the enormous problems we have in Europe. But a protest right in front of my hotel served as a timely [...]

I have just arrived in Chicago to talk about the Eurozone crisis at a conference organised by the Goethe Institute and the Federal Reserve Bank of Chicago. It is very easy to become self-centred given the enormous problems we have in Europe. But a protest right in front of my hotel served as a timely [...] Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Blogs Spain to Default Spanish Bonds to be Restructured like Greek PSI Jul 24 2012 Readers following the news know that as of quite recent , a total of seven Spanish provinces have now checked in to alert all that they are insolvent and will need Spanish government bailouts . The trouble is that Spain itself will be out of cash by August , and as

Subscribe About Michael Maloney The Company Hiring Opportunities Premium Content Current Analysis Classic Maloney Essays Fundamentals How-To Events Contact Search Login The Weekly Cycle Market Insights Every Wednesday Wealth Cycle Principle Start My Trial Home Premium Current Analysis Economics 101 How To Invest All Recent Articles Video Resources External Resources FAQ Glossary Visual Economy Blogs Market Commentary Chart Blog Login Register Home Blogs Spain to Default Spanish Bonds to be Restructured like Greek PSI Jul 24 2012 Readers following the news know that as of quite recent , a total of seven Spanish provinces have now checked in to alert all that they are insolvent and will need Spanish government bailouts . The trouble is that Spain itself will be out of cash by August , and as For the second time in the last year or so, the WSJ has floated a story about possible Fed intervention while the market was open, something that is very rare. The S&P 500 rallied 10 points in the final forty-five minutes of trading. This text below was posted on the WSJ’s blog before the close: [...]

For the second time in the last year or so, the WSJ has floated a story about possible Fed intervention while the market was open, something that is very rare. The S&P 500 rallied 10 points in the final forty-five minutes of trading. This text below was posted on the WSJ’s blog before the close: [...] We have added some hedges to our accounts today due to the developments described below. We are open further defensive moves in the coming days should conditions warrant.

In a July 22 video, we noted the weekly chart of the All World Stock Index Ex-US (VEU) “could go either way” and emphasized the need to [...]

We have added some hedges to our accounts today due to the developments described below. We are open further defensive moves in the coming days should conditions warrant.

In a July 22 video, we noted the weekly chart of the All World Stock Index Ex-US (VEU) “could go either way” and emphasized the need to [...] Greece is unlikely to be able to pay what it owes and further debt restructuring is likely to be necessary, three EU officials said on Tuesday, a cost that would have to fall on the European Central Bank and euro zone governments.

read more

Greece is unlikely to be able to pay what it owes and further debt restructuring is likely to be necessary, three EU officials said on Tuesday, a cost that would have to fall on the European Central Bank and euro zone governments.

read more : : Econbrowser Analysis of current economic conditions and policy The fiscal cliff and rationality Main Crowding Out Watch : July 2012 July 23, 2012 The Path Not Taken Thus Far : Debt Deleveraging by Inflation From the latest issue of the Milken Institute Review Trends : Better Living Through Inflation” co-authored with Jeffry Frieden If the aftermath of the Great Recession doesn’t feel like the recovery from a normal cyclical downturn , that’s because it wasn’t a normal cyclical downturn . We’re living through the consequences of a massive global debt crisis , and debt-driven crises produce an especially malign form of recession . The politics of debt is , if anything , more daunting than the economics . A debt crisis typically degenerates into bitter political conflict over who will

: : Econbrowser Analysis of current economic conditions and policy The fiscal cliff and rationality Main Crowding Out Watch : July 2012 July 23, 2012 The Path Not Taken Thus Far : Debt Deleveraging by Inflation From the latest issue of the Milken Institute Review Trends : Better Living Through Inflation” co-authored with Jeffry Frieden If the aftermath of the Great Recession doesn’t feel like the recovery from a normal cyclical downturn , that’s because it wasn’t a normal cyclical downturn . We’re living through the consequences of a massive global debt crisis , and debt-driven crises produce an especially malign form of recession . The politics of debt is , if anything , more daunting than the economics . A debt crisis typically degenerates into bitter political conflict over who will The markets would be very receptive to open-ended QE. Seems unlikely to happen in the short-run, but quite likely longer-term. From Reuters:

An open-ended round of quantitative easing that could be adjusted to suit economic conditions should be considered if the Fed launches a fresh round of monetary stimulus, a top policy official in [...]

The markets would be very receptive to open-ended QE. Seems unlikely to happen in the short-run, but quite likely longer-term. From Reuters:

An open-ended round of quantitative easing that could be adjusted to suit economic conditions should be considered if the Fed launches a fresh round of monetary stimulus, a top policy official in [...] It is unbelievable that after all these months German policymakers continue to make the same mistakes, over and over. And its media are making things even worse. The economics minister Philip Roesler gave a weekend interview in which he opined that he was sceptical that Greece could meet its reform requirements, that no further money [...]

It is unbelievable that after all these months German policymakers continue to make the same mistakes, over and over. And its media are making things even worse. The economics minister Philip Roesler gave a weekend interview in which he opined that he was sceptical that Greece could meet its reform requirements, that no further money [...] From Project Syndicate: While the risk of a disorderly crisis in the eurozone is well recognized, a more sanguine view of the United States has prevailed. For the last three years, the consensus has been that the US economy was on the verge of a robust and self-sustaining recovery that would restore above-potential growth. That [...]

From Project Syndicate: While the risk of a disorderly crisis in the eurozone is well recognized, a more sanguine view of the United States has prevailed. For the last three years, the consensus has been that the US economy was on the verge of a robust and self-sustaining recovery that would restore above-potential growth. That [...] : : , , . Econbrowser Analysis of current economic conditions and policy Would Regulation of Libor Have Passed Senator Shelby’s Benefit-Cost Analysis Main The fiscal cliff and rationality July 20, 2012 Wisconsin Employment Release for June : Payroll , Private , Civilian Employment . Decline The BLS has released preliminary estimates for June employment in Wisconsin . Private payrolls declined 11.7 thousand while total nonfarm payroll declined 13.2 thousand 0.5 and 0.5 respectively , using log differences at seasonally adjusted rates . Civilian employment decreased 7.9 thousand 0.3 At annualized rates , these would be 6 5.8 and 3.3 respectively It is interesting to observe that none of these figures are cited in the text of the Wisconsin Department of Workforce Development press release

: : , , . Econbrowser Analysis of current economic conditions and policy Would Regulation of Libor Have Passed Senator Shelby’s Benefit-Cost Analysis Main The fiscal cliff and rationality July 20, 2012 Wisconsin Employment Release for June : Payroll , Private , Civilian Employment . Decline The BLS has released preliminary estimates for June employment in Wisconsin . Private payrolls declined 11.7 thousand while total nonfarm payroll declined 13.2 thousand 0.5 and 0.5 respectively , using log differences at seasonally adjusted rates . Civilian employment decreased 7.9 thousand 0.3 At annualized rates , these would be 6 5.8 and 3.3 respectively It is interesting to observe that none of these figures are cited in the text of the Wisconsin Department of Workforce Development press release BERLIN —Greece’s new leaders have had only a month to confront their country’s dismal tangle of economic problems, but some in Europe think the troubled Mediterranean country is up against a hopeless task.

read more

BERLIN —Greece’s new leaders have had only a month to confront their country’s dismal tangle of economic problems, but some in Europe think the troubled Mediterranean country is up against a hopeless task.

read more I am currently giving a lot of talks in Europe and the US about the Eurozone crisis, how to understand it and what kind of reforms are needed to set the currency area onto a more sustainable course. Some of these thoughts are summarised in an article recently published on this website. There is, however, [...]

I am currently giving a lot of talks in Europe and the US about the Eurozone crisis, how to understand it and what kind of reforms are needed to set the currency area onto a more sustainable course. Some of these thoughts are summarised in an article recently published on this website. There is, however, [...] : , Greek Default Watch A blog about Greece's need to create a sustainable economic path for itself and to do so quickly , in difficult circumstances , and under great . pressure Pages Home Greece in Figures Greek Crisis Timeline Q on the Greek Crisis The Big Picture Sunday , July 15, 2012 One European Crisis , Different National Fates We often use the term European Crisis , 8221 but not every country in Europe is experiencing the crisis in the same way . In fact , there are several countries that are doing quite well . On a sub-national level , Eurostat reported that unemployment in 2011 ranged from 2.5 in Salzburg and Tirol in Austria to 30.4 in Andalucía in Spain . These three regions are occupying the same economic space only in a very abstract way . Inspired by that report , I looked

: , Greek Default Watch A blog about Greece's need to create a sustainable economic path for itself and to do so quickly , in difficult circumstances , and under great . pressure Pages Home Greece in Figures Greek Crisis Timeline Q on the Greek Crisis The Big Picture Sunday , July 15, 2012 One European Crisis , Different National Fates We often use the term European Crisis , 8221 but not every country in Europe is experiencing the crisis in the same way . In fact , there are several countries that are doing quite well . On a sub-national level , Eurostat reported that unemployment in 2011 ranged from 2.5 in Salzburg and Tirol in Austria to 30.4 in Andalucía in Spain . These three regions are occupying the same economic space only in a very abstract way . Inspired by that report , I looked Sign in Join Home Investor Blogs Global Emerging Markets Stock Research Multimedia Investment News Thoughts From The Frontline The Beginning of the Endgame The Beginning of the Endgame Thoughts From The Frontline Home About Contact Blog Subscription Form Email Notifications Go Syndication RSS for Posts Atom RSS for Comments Frontline Thoughts Audio Don't have time to read the weekly newsletter The audio version of my Frontline Thoughts are now available via Podcast on InvestorsInsight.com . nbsp Consume the feed here Have You Seen This Recent Posts Gambling in the House The Lion in the Grass The Beginning of the Endgame Into the Matrix Bull’s Eye Investing Almost Ten Years Later Tags China Consumer Spending Credit Crisis Debt Deficit Deflation Economic Forecast Economy Employment Euro

Sign in Join Home Investor Blogs Global Emerging Markets Stock Research Multimedia Investment News Thoughts From The Frontline The Beginning of the Endgame The Beginning of the Endgame Thoughts From The Frontline Home About Contact Blog Subscription Form Email Notifications Go Syndication RSS for Posts Atom RSS for Comments Frontline Thoughts Audio Don't have time to read the weekly newsletter The audio version of my Frontline Thoughts are now available via Podcast on InvestorsInsight.com . nbsp Consume the feed here Have You Seen This Recent Posts Gambling in the House The Lion in the Grass The Beginning of the Endgame Into the Matrix Bull’s Eye Investing Almost Ten Years Later Tags China Consumer Spending Credit Crisis Debt Deficit Deflation Economic Forecast Economy Employment Euro (This post’s “possibly irrelevant image” comes from an incredible series of Kodachrome photos at English version of Pavel Kosenko’s blog. The images are beautiful and interesting. Definitely irrelevant to the post, though.) (1) A bit on Libor: I’ve asked a … Continue reading →

(This post’s “possibly irrelevant image” comes from an incredible series of Kodachrome photos at English version of Pavel Kosenko’s blog. The images are beautiful and interesting. Definitely irrelevant to the post, though.) (1) A bit on Libor: I’ve asked a … Continue reading → It’s an awkward question but one that must be raised repeatedly. Does Germany really want the euro to survive? Was the beloved DM sacrificed for unification? The German public—like their counterparts around the world—appear to be unduly influenced by their jingoistic press, one which tends to see Germans as the much-maligned victims of a Eurozone [...]

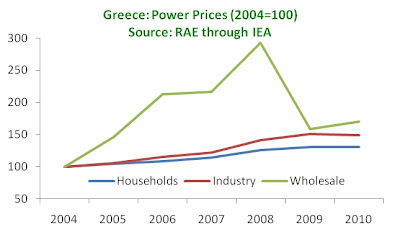

It’s an awkward question but one that must be raised repeatedly. Does Germany really want the euro to survive? Was the beloved DM sacrificed for unification? The German public—like their counterparts around the world—appear to be unduly influenced by their jingoistic press, one which tends to see Germans as the much-maligned victims of a Eurozone [...] : Greek Default Watch A blog about Greece's need to create a sustainable economic path for itself and to do so quickly , in difficult circumstances , and under great . pressure Pages Home Greece in Figures Greek Crisis Timeline Q on the Greek Crisis The Big Picture Thursday , July 12, 2012 Should Greece Restructure and Privatize its Power Company The New Democracy-led coalition is gearing up for its first big fight against the labor union of the Public Power Corporation PPC , or ΔΕΗ in Greek This is good news because we will know soon whether the government has what it takes to implement reforms . Lose this battle , and it will lose the war . Yet amid the bullying and the threats , there is also a quasi-argument brewing : an argument that Greece’s low tariffs for electricity are proof

: Greek Default Watch A blog about Greece's need to create a sustainable economic path for itself and to do so quickly , in difficult circumstances , and under great . pressure Pages Home Greece in Figures Greek Crisis Timeline Q on the Greek Crisis The Big Picture Thursday , July 12, 2012 Should Greece Restructure and Privatize its Power Company The New Democracy-led coalition is gearing up for its first big fight against the labor union of the Public Power Corporation PPC , or ΔΕΗ in Greek This is good news because we will know soon whether the government has what it takes to implement reforms . Lose this battle , and it will lose the war . Yet amid the bullying and the threats , there is also a quasi-argument brewing : an argument that Greece’s low tariffs for electricity are proof Filed under: Ellen Brown Articles/Commentary

Filed under: Ellen Brown Articles/Commentary (1) Pampering Pooches Wealth inequality has reached a new high (or low): Paris Hilton’s dogs are now worth more than you. Alternet reports that the heiress recently constructed a $350,000 doghouse for her canine companions. While a million people in … Continue reading →

(1) Pampering Pooches Wealth inequality has reached a new high (or low): Paris Hilton’s dogs are now worth more than you. Alternet reports that the heiress recently constructed a $350,000 doghouse for her canine companions. While a million people in … Continue reading → Read article here. Filed under: Ellen Brown Articles/Commentary

Read article here. Filed under: Ellen Brown Articles/Commentary